The Gurugram ED Fraud Probe: How Homebuyers’ ₹205 Crore was Diverted to Sri Lanka

In a major development that has once again put the spotlight on real estate malpractice, the Enforcement Directorate (ED) has placed a Gurugram-based realty firm, Krrish Realtech, under intense scrutiny. This new chapter in the ongoing fight against financial crime centers around an ED fraud probe that alleges a massive misappropriation of public funds.

According to the ED’s chargesheet, the company and its promoter, Amit Katyal, are accused of defrauding over 400 homebuyers by illicitly collecting more than ₹500 crore for a residential plot project in Gurugram. The most shocking revelation from the investigation is that a significant portion of this money—specifically, ₹205 crore—was allegedly diverted to fund a hotel and real estate project in Colombo, Sri Lanka. This detailed summary will explain the key aspects of the case and the actions taken by the Enforcement Directorate.

Understanding the Allegations of Real Estate Fraud and the Role of the ED : ED fraud probe

The core of the matter lies in the alleged deception perpetrated by the realty firm. They reportedly enticed customers with the promise of residential plots on a 70-acre land parcel. However, the ED’s investigation revealed that the company did not even hold the necessary licenses to legally undertake such a project. This alleged lack of legal authority is a cornerstone of the ED fraud probe, demonstrating a clear intent to deceive from the very beginning. Instead of using the collected funds for their stated purpose, the money was allegedly siphoned off and routed through a series of shell companies to conceal the true financial trail.

The ED’s chargesheet explicitly names a shell company, Mahadev Infrastructure, as the vehicle used to divert the ₹205 crore to the Colombo project. This act of financial layering is a common tactic in money laundering schemes, making it difficult for investigators to trace the funds back to their origin. The investigation also found that some of the money was used to buy properties and land in the names of other “front” companies, as well as in the names of the promoters’ family members and employees. This multifaceted approach to money laundering underscores the complexity of the financial crime at the heart of the ED fraud probe.

The impact on the homebuyers is devastating. The ED’s findings confirm that the promoters never intended to hand over the plots. The agency’s investigation further revealed a series of alleged fraudulent attempts by the company to manipulate the situation to their advantage, including trying to create fictitious creditors and falsifying the list of plot buyers submitted to a Supreme Court-appointed committee. These actions, as highlighted by the ED fraud probe, demonstrate a deliberate effort to evade accountability and legal obligations. The homebuyers, who had invested their life savings, were left with nothing.

In response, the ED has taken decisive action, conducting searches and provisionally attaching assets to the tune of hundreds of crores. These attached assets include not only the land parcels in Gurugram but also the realty project in Sri Lanka that was allegedly funded by the diverted money. This move by the ED is crucial as it aims to recover the “proceeds of crime” and provide some measure of restitution to the victims. The legal process is now underway, with a local PMLA court having issued a notice to the accused, paving the way for further judicial proceedings.

This case is part of a broader trend of increased scrutiny by the ED on real estate firms suspected of financial misconduct. The promoter of Krrish Realtech, Amit Katyal, has been previously arrested in a separate money laundering case, further emphasizing a pattern of alleged fraudulent behavior. The vigilance of the ED in pursuing such cases under the PMLA is a critical step in restoring trust and transparency in the real estate sector. The ongoing ED fraud probe sends a powerful message that those who defraud homebuyers will face serious legal consequences and asset forfeiture. It is a reminder to the public to exercise extreme caution and conduct thorough due diligence before making significant real estate investments.

Source: Mint

Israel Aerospace Industries Gurugram Office Secures 45,000 Sq Ft, Bolstering ‘Make in India’ Initiatives

Israel Aerospace Industries Gurugram office – In a significant move poised to strengthen the strategic partnership between India and Israel, a subsidiary of Israel Aerospace Industries (IAI) has finalized a major real estate transaction in Gurugram, India. This development marks a new phase in the collaboration between the two nations, particularly in the critical sectors of defence and technology.

The subsidiary, Israel Aerospace India Services Pvt Ltd, has leased a sprawling office space, signaling its commitment to establishing a robust operational presence in the country. This expansion is not merely a commercial transaction; it is a tangible step towards fulfilling the goals of the “Atmanirbhar Bharat” (Self-Reliant India) and “Make in India” initiatives, which aim to bolster the domestic defence manufacturing and maintenance ecosystem. The new facility is set to become a large-scale hub for maintenance, repair, and overhaul (MRO) of sophisticated defence equipment.

The transaction involves the lease of a substantial 45,277 square feet of prime office space. This facility is located at the prestigious Intellion IT Park in Sector 59, Gurugram, a rapidly emerging corporate hub known for attracting leading global technology and defence firms. The leased space, situated on the 12th floor of Tower 1, is slated to become a crucial centre for the company’s future operations.

The financial details of the lease agreement are equally noteworthy. The deal, which spans a five-year period, was sealed for a monthly rent of ₹32.14 lakh. This translates to an impressive total lease value of approximately ₹20.5 crore over the duration of the agreement. The lessor for this transaction is Mikado Realtors Pvt Ltd, a real estate entity with ties to the venerable Tata Group, further underscoring the high-profile nature of this deal.

Strategic Importance of the Israel Aerospace Industries Gurugram Office

The establishment of this new office is of immense strategic importance. It is a direct result of the growing defence cooperation between India and Israel, which has seen both countries engage in joint ventures and technology transfers. By setting up a dedicated MRO facility within India, IAI will contribute to the local economy, create high-skilled jobs, and enhance India’s indigenous capabilities in maintaining and servicing its defence assets. The leased space has been officially approved for a range of IT-enabled services, including essential repair, maintenance, and comprehensive business support functions, providing a solid foundation for these operations.

Gurugram’s emergence as the preferred location for such a significant undertaking is no accident. The city, part of the National Capital Region (NCR), has evolved into a powerhouse for corporate and technological ventures. Its appeal is rooted in its world-class infrastructure, connectivity, and a thriving ecosystem of skilled talent.

The city’s status as a major IT and financial hub makes it an ideal choice for companies like IAI, which require a robust support network and access to a professional workforce. The real estate market in Gurugram has been witnessing a surge in large-scale office leases, with other notable companies also recently securing substantial spaces. This trend highlights Gurugram’s sustained appeal and its potential to be a nexus for international businesses expanding their footprint in India. The establishment of this Israel Aerospace Industries Gurugram office underscores this trend, demonstrating the city’s allure for major international corporations.

The long-term implications of the Israel Aerospace Industries Gurugram office are profound. It represents a vote of confidence in India’s economic and strategic trajectory. For IAI, a global leader in defence and aerospace technology, this new hub will streamline its operations, improve service delivery to Indian clients, and facilitate deeper integration into the Indian defence landscape. It will also serve as a crucial base for transferring technological expertise and fostering innovation.

The establishment of the new Israel Aerospace Industries Gurugram office is a milestone that reflects a strengthening bond and a shared commitment to security, innovation, and self-reliance, paving the way for a more collaborative and prosperous future for both nations. This venture is expected to catalyze further investment from other international defence and technology firms, reinforcing India’s position as a key player in the global defence supply chain. The new Israel Aerospace Industries Gurugram office is therefore more than just a real estate transaction; it’s a strategic investment in a long-term partnership.

Israel Aerospace Industries Gurugram office

Source : HT

Revolutionizing Indian Real Estate with Digital Land Records

The digital transformation sweeping across India has finally reached one of the nation’s most complex and critical sectors: land management. The ambitious project to digitize all land records is poised to become a cornerstone of the country’s economic future, fundamentally altering the real estate market. This initiative is designed to tackle the deep-seated issues that have long made land transactions opaque and high-risk. By creating a unified, accessible, and secure database of digital land records, the government is effectively building a bridge of trust between investors and the market, thereby fueling an increase in both domestic and foreign investment. The reform is a crucial step towards modernizing the economy and placing India on par with globally competitive markets.

The Economic Impact: Boosting Investor Confidence and Capital Inflows

Institutional investors, both foreign and domestic, have historically been wary of the risks associated with land acquisition in India. The uncertainty surrounding property titles and the potential for legal disputes often made them hesitant to commit large sums of capital. The shift to digital land records changes this dynamic entirely. By providing a clear and indisputable record of ownership, the new system offers the security and confidence that large-scale investors demand.

This is already being reflected in a significant upswing in institutional investment, as highlighted by recent market reports. The enhanced transparency is not merely a convenience; it is a powerful economic catalyst, attracting substantial capital inflows and driving market liquidity. This influx of capital is critical for funding large-scale infrastructure projects, commercial developments, and housing schemes that are essential for India’s sustained economic growth and urbanization.

Streamlining Processes for Developers and Owners: Digital Land Records

For real estate developers, the digitization of records is a game-changer. The single biggest challenge they have faced, especially for land-intensive projects like townships, warehousing facilities, and data centers, is the tedious and often litigious process of acquiring land. Issues such as disputed ownership, poorly recorded titles, and an absence of mutation records have made the process expensive and time-consuming. The new system of digital land records dramatically simplifies this.

Developers can now verify land titles quickly, reducing the time and cost associated with due diligence. This newfound efficiency enables them to fast-track projects, from initial planning to final delivery, which is a major win for both the industry and consumers. It also allows developers to focus on innovation and quality, rather than getting bogged down in legal and procedural bottlenecks.

Enhancing Transparency and Minimizing Fraud

One of the most profound benefits of the digital system is its role in curbing fraudulent land deals. The traditional paper-based system was vulnerable to manipulation, leading to countless instances of fraud and property disputes. A secure, centralized registry of digital land records provides an unalterable and transparent trail of ownership. This significantly minimizes the risk of fraudulent transactions and ensures that all parties involved can verify the authenticity of the records.

This move not only protects investors and developers but also provides greater security and peace of mind for individual property owners. The system is a vital tool for establishing a fair and secure real estate market that operates on a foundation of trust and reliability, fostering a more conducive environment for sustained growth.

Empowering the Individual Homebuyer

While the impact on large-scale investors and developers is significant, the benefits of digital land records extend directly to the common citizen. For an individual looking to buy a new home, the process has often been fraught with anxiety. The fear of purchasing a property with a disputed title, the hassle of visiting multiple government offices, and the need to rely on middlemen have been major pain points. With digitized records, a prospective homebuyer can now conduct a preliminary check on the property’s legal status from the comfort of their home, or through their lawyer, with greater ease and accuracy.

This reduces the risk of scams and provides an added layer of security. Furthermore, the process of registering a new property is becoming more streamlined and less time-consuming as sub-registrar offices are now computerized. This simplification of the entire property transaction lifecycle empowers citizens, making property ownership a more accessible and secure aspiration for everyone. The transparency created by these digital land records is the key to unlocking the full potential of India’s real estate market for all its stakeholders.

Source: TOI

Haryana RERA Orders Developer to Pay for Flat Handover Delay

Haryana RERA Order – In a significant development for the real estate sector and a major win for frustrated homebuyers, the Haryana Real Estate Regulatory Authority (HRERA) has issued a landmark ruling. The authority has directed Agrante Realty to compensate buyers of its ‘Kavyam’ affordable housing project in Sector 108, for the inordinate delay in handing over their flats. This decision shines a spotlight on the persistent issue of project delays and reaffirms Haryana RERA commitment to protecting the interests of consumers.

The story is a familiar one to countless individuals who have invested their life savings into a dream home, only to be met with endless waiting and unfulfilled promises. For the homebuyers of the ‘Kavyam’ project, the promised completion date of February 20, 2024, came and went without any sign of a flat handover. Despite the developer, Agrante Realty, having collected a substantial portion of the project cost, the completion of essential amenities remained stalled, leaving buyers in a state of limbo. This is a classic case of Haryana RERA flat handover delay, and it highlights the urgent need for strict regulatory oversight in the real estate industry.

Developers often cite a variety of reasons for these delays, ranging from supply chain disruptions to regulatory hurdles. In this specific case, Agrante Realty attempted to use the Covid-19 pandemic and pollution-related construction bans as justifications for the stalled project. While these events undoubtedly caused short-term disruptions, Haryana RERA rightly dismissed these claims, stating they did not warrant such a prolonged and significant delay. The authority emphasized that these were temporary setbacks that should not be used as an excuse to neglect the long-term commitments made to homebuyers.

Haryana RERA Orders

The ruling by HRERA is a powerful message to all developers. It makes it clear that they will be held accountable for their promises. The authority has not only ordered the builder to complete the pending amenities but has also directed them to pay a monthly interest of 11.1% on the amounts deposited by the buyers.

This financial penalty is a crucial deterrent against future delays and provides a much-needed remedy for the financial and emotional distress caused to the affected families. The enforcement of such penalties is vital to maintain trust and transparency in the real estate sector. The precedent set by this Haryana RERA flat handover delay case will hopefully empower more homebuyers to seek justice and hold developers to their timelines.

The real estate sector in India has long been plagued by a lack of regulation, leading to widespread consumer exploitation. The establishment of regulatory bodies like HRERA under the Real Estate (Regulation and Development) Act, 2016 (RERA), was a game-changer. These authorities are tasked with ensuring transparency, fair practices, and accountability. The Agrante Realty case demonstrates the effectiveness of RERA in action.

It shows that the mechanism is in place to address grievances and deliver a tangible result for consumers. The 11.1% interest rate is a significant figure, well above standard bank interest rates, and is designed to truly compensate buyers for their loss and inconvenience. It signals that HRERA is not just a passive body but an active force fighting for consumer rights. The compensation for a Haryana RERA flat handover delay is more than just a financial transaction; it’s a validation of the buyers’ faith in the system.

This ruling also has a ripple effect. It sends a strong signal to other developers who may be considering delaying their projects. They now know that consumers have a powerful recourse and that the consequences of non-compliance can be severe. This could lead to a more disciplined and professional real estate environment. For potential homebuyers, this provides a greater sense of security. Knowing that there is a robust regulatory framework to protect their investment makes the decision to purchase a property less risky. The Agrante Realty case is a perfect example of why it’s so important to have a strong and effective regulatory body to combat Haryana RERA flat handover delay issues.

The journey for the ‘Kavyam’ homebuyers is far from over. While the order is a huge victory, the challenge now lies in its swift and effective implementation. The buyers will be keenly watching to ensure that the developer not only pays the ordered compensation but also completes the project within the stipulated new deadlines. This ruling is a testament to the power of collective action and the importance of having a robust legal framework to protect the rights of common citizens against powerful entities.

This case serves as a beacon of hope for all those struggling with similar issues across the country. It reinforces the idea that justice can be served and that regulatory bodies, when functioning effectively, can bring about meaningful change. The fight against unscrupulous practices in the real estate sector is a long one, but rulings like this mark significant milestones on the path to a fair and transparent market. Every instance of Haryana RERA flat handover delay that is successfully challenged brings us closer to that goal.

Source :- TOI

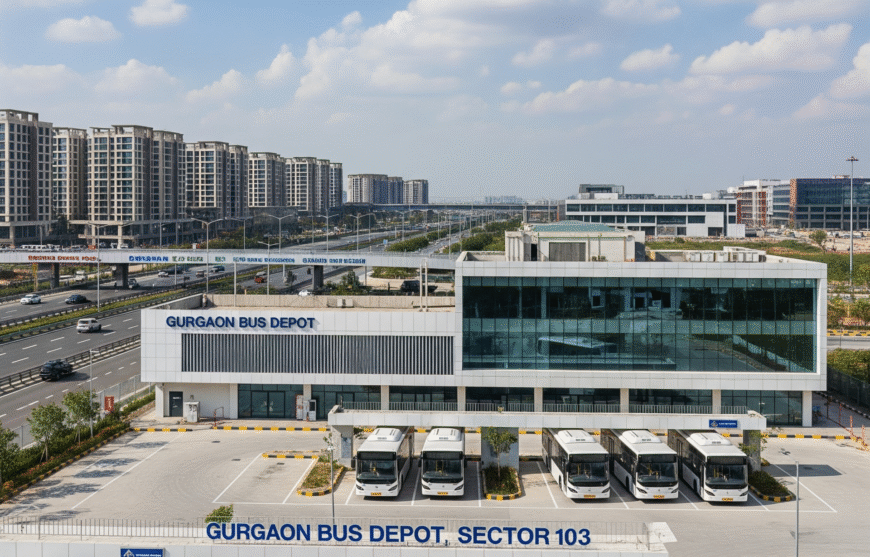

New Bus Depot in Sector 103 Set to Transform Dwarka Expressway Connectivity

Dwarka Expressway Connectivity – The urban landscape of Gurgaon is constantly evolving, with new infrastructure projects aimed at improving connectivity and enhancing the quality of life for its residents. A significant step in this direction is the proposed new bus depot in Sector 103, a project spearheaded by the Gurgaon Metropolitan Development Authority (GMDA). This initiative is part of a larger, strategic plan to bolster the city’s public transport network, particularly along the burgeoning Dwarka Expressway, which has become a vital artery for daily commuters. The new bus depot will significantly improve Dwarka Expressway connectivity.

The need for a robust public transport system has never been more critical. As the city’s population continues to grow and more residents move into the residential sectors along the Dwarka Expressway, the demand for efficient and sustainable travel options has surged. The GMDA recognizes this and is taking proactive measures to meet these demands. The new bus depot, strategically located near the upcoming Sheetla Mata Medical College and Hospital, is envisioned as a central hub that will streamline bus operations and provide seamless services to a wide area, thereby enhancing Dwarka Expressway connectivity.

This project is not just about building a physical structure; it is about creating a more connected and accessible urban environment. The GMDA has enlisted Delhi Integrated Multi-Modal Transit System Ltd (DIMTS) as the project management consultant. This partnership is crucial for ensuring the depot is meticulously planned and executed. DIMTS is currently preparing the concept plan and a detailed project report, which will lay out the blueprint for the entire facility, from its layout to its operational mechanics. The thoroughness of this preliminary work ensures that the depot will be a state-of-the-art facility, capable of handling the city’s growing bus fleet. This is a crucial step for boosting overall Dwarka Expressway connectivity.

Revolutionizing Public Transport and Dwarka Expressway Connectivity

The site for the depot, a substantial 7.18 acres, was recently transferred from the Municipal Corporation of Gurgaon (MCG) to the GMDA. This land acquisition marks a significant milestone and clears the way for construction to begin. The design for the depot is ambitious and comprehensive. It is planned to accommodate an impressive fleet of up to 150 buses, a capacity that will significantly expand the city’s public transport reach. The depot will feature dedicated parking bays, ample operational space for efficient vehicle movement, and modern maintenance facilities. These features are essential for ensuring the longevity of the bus fleet and the reliability of the services it provides, which will directly impact Dwarka Expressway connectivity.

One of the primary goals of this project, as stated by RD Singhal, chief general manager of the mobility division at GMDA, is to promote sustainable public transport. In an age where environmental concerns are paramount, reducing the city’s reliance on private vehicles is a key objective. By providing a comfortable, reliable, and eco-friendly alternative, the GMDA hopes to encourage more people to use public buses. This shift will not only alleviate traffic congestion on major roads like the Dwarka Expressway but also contribute to a reduction in carbon emissions, making Gurgaon a cleaner and greener city. All these efforts are aimed at improving Dwarka Expressway connectivity.

The proposed depot is expected to bring about a monumental shift in the efficiency of the city’s bus operations. By centralizing the bus fleet in a modern facility, GMDA can optimize routes, reduce turnaround times, and ensure buses are well-maintained and ready for service. This improved efficiency will translate directly into better services for commuters.

Residents living in sectors along the Dwarka Expressway, as well as those traveling to and from the Sheetla Mata Medical College and Hospital, will benefit from more frequent and reliable bus services. The increased Dwarka Expressway connectivity will make it easier for people to access key areas of the city for work, education, and healthcare, thereby boosting the overall economic and social fabric of the region.

The development of the Sector 103 bus depot is a testament to GMDA’s commitment to building a smart, sustainable, and well-connected city. It represents a forward-thinking approach to urban planning, one that prioritizes public welfare and environmental sustainability. As the project moves from the planning stage to execution, it holds the promise of transforming the public transport landscape in Gurgaon, making daily commutes more comfortable and efficient for thousands of people. This project is a major step towards enhancing overall Dwarka Expressway connectivity.

Source:- TOI