9 years on, Housing Project stuck : Gurgaon Housing Fraud

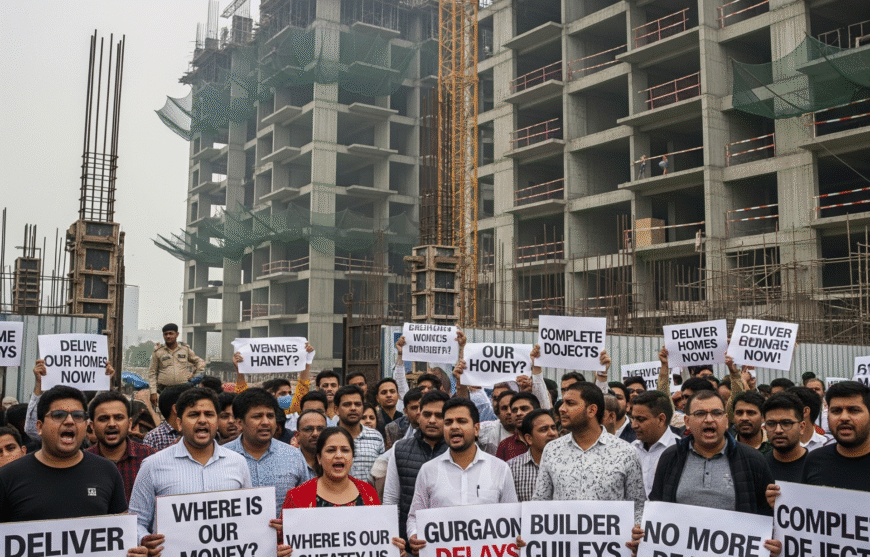

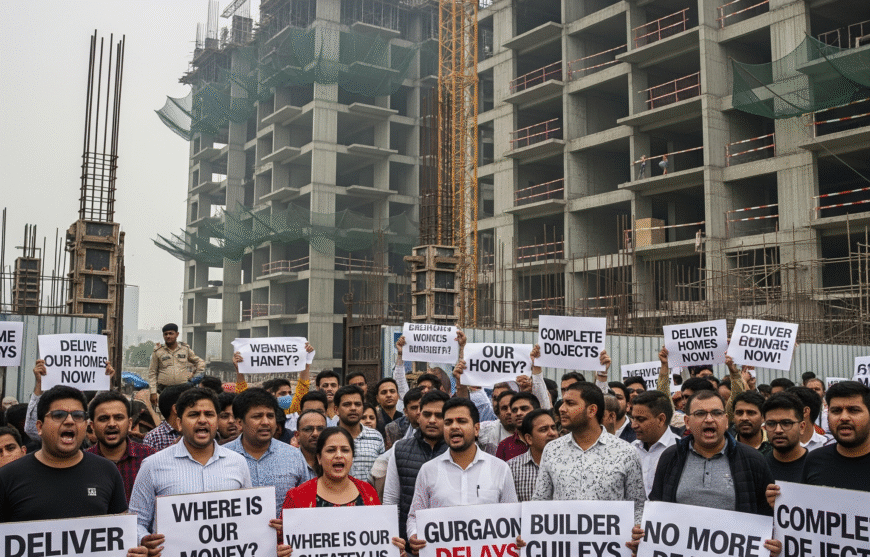

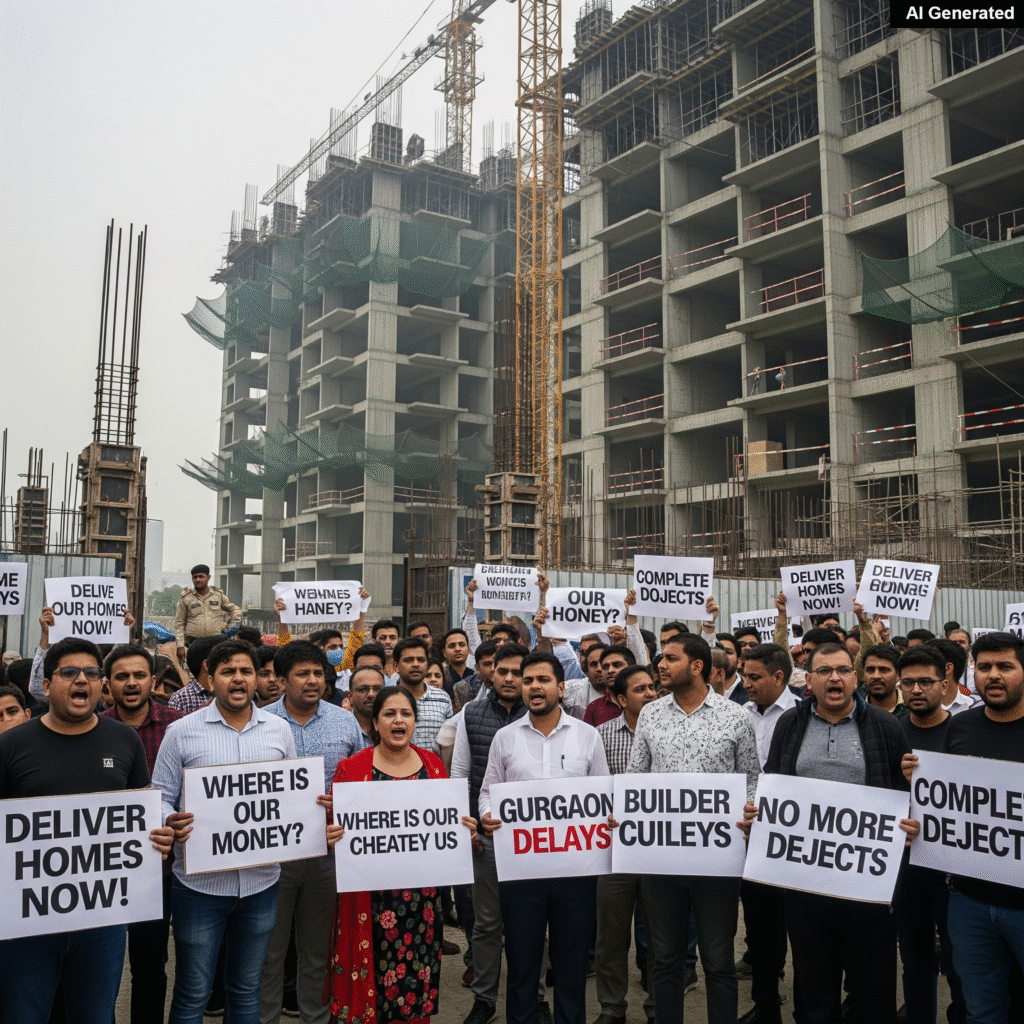

A grim tale of unfulfilled promises and financial distress is unfolding in Gurgaon, where over 3,000 homebuyers are caught in a protracted dispute with a real estate developer. For nearly a decade, these investors in the Expressway Towers project have been waiting for their homes, a wait now marked by allegations of a major Gurgaon housing fraud.

The project, launched in November 2016 under the government’s Affordable Housing Scheme, was meant to be a beacon of hope for middle-class families. Instead, it has become a symbol of a systemic failure, with construction stalled at a mere 65% completion. The homebuyers, who have collectively invested their life savings and are burdened with both rent and EMIs, recently staged a protest to voice their frustration and demand justice against the alleged developer’s misconduct.

The homebuyers’ association points to a blatant diversion of funds as the primary cause of the project’s stagnation. They allege that the builder, Swaraj Singh Yadav, and his wife, Sunita Swaraj Yadav, who is also a co-director of Ocean Seven Buildtech Pvt Ltd, funneled the collected funds into other ventures, leaving the Expressway Towers project in limbo. This alleged Gurgaon housing fraud has left thousands in a state of financial and emotional turmoil, their dreams of homeownership shattered.

A protesting homebuyer emotionally stated that they were promised possession by 2020, but almost five years later, they are still waiting, a sentiment that resonates with countless others in similar situations across the National Capital Region. The company’s refusal to share financial records with investigating authorities further fueled the homebuyers’ suspicions and strengthened their resolve to fight for accountability.

Legal Escalation on Gurgaon Housing Fraud

In a legal escalation, a complaint has been lodged with the Economic Offences Wing (EOW-2, Manesar), which suspects violations under the Prevention of Money Laundering Act (PMLA), 2002. This move signals the serious nature of the allegations and the potential for a wider investigation into the financial dealings of Ocean Seven Buildtech Pvt Ltd. The homebuyers’ association has pledged to continue their public protests and escalate the matter to higher state and central agencies to ensure that the individuals responsible for this widespread Gurgaon housing fraud are held accountable.

They are determined to see the legal process through, hoping for a resolution that will either lead to the completion of the project or a full refund of their investments. The legal action adds a significant layer to the conflict, transforming a local protest into a formal legal battle against a powerful real estate entity.

Meanwhile, the developer has presented a counter-narrative, painting a different picture of the situation. According to a company spokesperson, the project’s delay was not due to a deliberate Gurgaon housing fraud but was a consequence of buyer protests and non-payment of dues, which they claim led to the suspension of their license and the freezing of their accounts.

The spokesperson asserted that despite these challenges, the company has completed over 90% of the work, a claim that starkly contrasts with the homebuyers’ assessment of 65% completion. In a recent meeting with the buyers’ association, the promoter reportedly assured them that possession would be delivered by March 2026. However, this assurance seems to have done little to quell the skepticism and anger of the homebuyers, who view the ongoing protests as a necessary measure to pressure the company and secure their future. The conflicting claims highlight the deep-seated mistrust between the two parties.

The situation in Gurgaon is a stark reminder of the risks involved in real estate investments and the need for stronger regulatory oversight. The allegations of this Gurgaon housing fraud have not only impacted the financial well-being of thousands but have also eroded public trust in the real estate sector. The outcome of this case could set a significant precedent for how such disputes are handled in the future.

As the legal and public battles continue, the fate of the Expressway Towers project and its long-suffering homebuyers hangs in the balance. The ongoing protests serve as a powerful testament to the collective power of citizens and their demand for transparency and justice in a market where they often feel vulnerable and unprotected.

Source: TOI

Gurugram Real Estate: How Gurugram’s Top Condos Are Being Redefined

Gurugram Real Estate – For the past decade, I’ve had a front-row seat to the evolution of the Gurugram real estate market. What was once a collection of industrial units has transformed into a sprawling, modern metropolis. Yet, for all its growth, the industry has often lacked a uniform, qualitative metric to truly assess the value of residential projects beyond the basic square footage and location. That’s why a new initiative, “Clash of Condominiums,” represents a significant step forward, promising to provide a much-needed benchmark for excellence.

This competition in gurugram real estate, launched by The Times of India, is a groundbreaking event. It shifts the conversation from a purely transactional one to a holistic evaluation of a society’s quality of life. For any potential investor or discerning homebuyer, this is an invaluable resource. The competition doesn’t just look at the luxury of a project; it delves deep into its operational efficiency, sustainability, and community health.

Judging criteria – Gurugram Real estate

The judging criteria for this Condominiums in Gurugram real estate are what make this competition so unique and relevant to the modern market. They are broken down into five key areas that all prospective buyers should consider:

- Infrastructure Support: This is the bedrock of any successful residential complex. This criterion goes beyond the basic provision of power and water to examine the robustness of a society’s physical and technical infrastructure. It evaluates everything from the efficiency of the security systems to the quality of the internal roads and the reliability of facility management, which are paramount for long-term property value.

- Commitment to Planet-Friendly Practices: In a world increasingly focused on environmental responsibility, this pillar is a key differentiator. The evaluation of eco-friendly initiatives, such as solar power integration, effective waste management and recycling, and water conservation measures, will increasingly influence a property’s market appeal and resale value.

- Community Bonds: A strong community is a proven factor in long-term resident satisfaction and property stability. This criterion assesses how societies facilitate social interaction, resident engagement, and the creation of a harmonious environment. For investors, this translates to lower churn rates and a more stable rental market.

- Thoughtful Amenities: While amenities are standard, their thoughtful execution is not. The competition judges the utility and maintenance of facilities. Are they truly adding value to residents’ lives, or are they just for show? An investor can gain valuable insights into how a society’s amenities contribute to its overall desirability and a premium rental yield.

- Proactive Management: The effectiveness of an RWA or managing committee is often a make-or-break factor for a residential project. This pillar measures their transparency, financial prudence, and ability to proactively address resident concerns. A well-managed society is a more secure and profitable investment in the long run.

The “Clash of Condominiums” is a multi-stage process. Societies will first nominate themselves, and entries will be sorted by zone: Old Gurugram, DLF phases and surrounding sectors, Golf Course Road Extension, and New Gurugram. The top-scoring societies from each zone will then form a “Super 20” list, which will be physically visited by an expert jury. This due diligence ensures that the final list of top 12 societies is credible and well-vetted.

This initiative is a fantastic development for the Gurugram real estate market. It provides a new level of transparency and data for buyers and investors, allowing them to make more informed decisions. It will also serve as a powerful incentive for developers and RWAs to focus on operational excellence and community building, ultimately raising the standard of living for everyone.

Gurugram real estate, this new list will not only celebrate the winners but will also serve as a crucial guide for potential buyers, highlighting what truly constitutes a valuable investment. It’s a shift from just looking at a property’s potential for capital appreciation to evaluating its long-term viability as a home. For the first time, prospective investors can look beyond glossy brochures and instead rely on a well-vetted, objective ranking system.

Source : TOI

Construction in Aravallis : Landmark NGT Notice to Co, Govts over Illegal

Aravalli mountain range, an ecological lifeline for North India, is once again at the center of a legal storm. The National Green Tribunal (NGT) has issued a powerful and far-reaching NGT notice to Co, Govts over illegal construction in Aravalli, a move that signals a serious crackdown on environmental violations. This is not just another bureaucratic directive; it represents a critical step toward holding both a private real estate firm and key government bodies accountable for alleged widespread illegal construction and a perceived failure to protect this ancient and fragile ecosystem. The notice, prompted by a citizen’s petition, highlights the growing conflict between unchecked urbanization and the urgent need for environmental preservation in the National Capital Region (NCR).

The Aravalli Legal Challenge: Unpacking the Allegations

The petition that triggered this legal action details a series of disturbing allegations. At its core is the claim that a real estate firm has undertaken massive construction—allegedly spanning over 400,000 square meters—in the ecologically sensitive Wazirabad ridge area of Gurgaon. The central accusation is that this project began without the necessary environmental clearance, a direct and brazen violation of the Environmental Impact Assessment (EIA) Notification, 2006. The EIA is a crucial legal framework designed to prevent exactly this kind of development in sensitive zones by mandating a thorough assessment of potential environmental damage before any construction can proceed.

Furthermore, the petition presents visual evidence—including photographs and satellite imagery—that reportedly shows significant encroachment into the forest. The images depict concrete structures, sheds, and a large parking lot built directly on the edge of the protected forestland. This physical encroachment not only destroys the natural habitat but also disrupts the delicate balance of the local ecosystem, which is home to a variety of flora and fauna. For years, environmentalists have warned that the unchecked construction activity in the Aravallis is leading to irreversible damage, including a loss of biodiversity and a disruption of natural water recharge cycles.

A Call for Accountability (Aravalli): The NGT’s Directive

The scope of the NGT’s notice is particularly notable because it extends beyond the private developer. The tribunal has also directed its inquiry toward several government agencies, including the Ministry of Environment, Forest and Climate Change (MoEF), the Haryana government, the State Environment Impact Assessment Authority (SEIAA), and the Haryana State Pollution Control Board (HSPCB).

This is a crucial aspect of the case, as the petition suggests a pattern of regulatory negligence and inaction on the part of these authorities. The argument is that despite the blatant violations, the government bodies failed to enforce the existing laws and prevent the construction from moving forward. This perceived lack of oversight has emboldened developers and created a climate where environmental laws are routinely flouted.

The Aravallis are more than just a mountain range; they are a vital climate regulator for the NCR. They act as a natural barrier against the desert winds from Rajasthan, a crucial groundwater recharge zone, and a green lung for the densely populated urban areas of Delhi, Gurgaon, and Faridabad. The continued degradation of this range has severe long-term consequences, including increased air pollution, water scarcity, and a decline in biodiversity. The current NGT case serves as a powerful reminder that the long-term health of the environment must be prioritized over short-term commercial gains.

The upcoming hearing will be a landmark event for environmental law in India. The outcome of this case could set a precedent for how future development projects are handled in ecologically sensitive areas. It is a critical moment for accountability, and all eyes will be on the responses of the implicated parties. This legal battle is a testament to the power of citizen activism and a renewed hope that the NGT’s intervention will finally lead to the strict enforcement of laws that protect our country’s precious natural resources.

Source:- TOI Aravalli

The New Era of Luxury Real Estate NCR: A Strategic Guide to High-Return Investments

Luxury Real Estate NCR: Reshaping the Landscape

The National Capital Region (NCR) is currently experiencing an unprecedented surge in its luxury real estate market, a phenomenon that is fundamentally reshaping the region’s urban landscape and investment potential. Driven by a confluence of robust economic growth, a new class of affluent homebuyers, and transformative infrastructure projects, the demand for high-end properties is soaring. This dynamic shift is moving the focus beyond traditional elite enclaves to new, high-growth corridors, offering exceptional opportunities for both discerning homebuyers and savvy investors. This rephrased article, focusing on the key phrase luxury real estate NCR, provides an in-depth look into the forces behind this boom and the strategic hotspots that are leading the charge.

Luxury real estate NCR: A Shift from Status Symbol to Lifestyle Statement

The modern definition of luxury real estate NCR has evolved significantly. It is no longer solely about the price tag or location but about an all-encompassing lifestyle. Today’s high-net-worth individuals (HNIs), including corporate executives, successful entrepreneurs, and non-resident Indians (NRIs), are not just buying a house; they are investing in a curated living experience. They seek properties that offer exclusivity, privacy, and a wide array of world-class amenities.

This includes everything from bespoke concierge services and private cinema halls to state-of-the-art wellness centers and lush green spaces. This paradigm shift has prompted developers to innovate, creating integrated communities and branded residences that offer a lifestyle previously only associated with five-star hotels. The result is a segment of the market that is remarkably resilient, even in the face of broader economic fluctuations. The strong desire for spacious, amenity-rich homes post-pandemic has further accelerated this trend, with buyers prioritizing well-being and a superior quality of life.

The Rise of New Hubs: Where to Find the Next High-Return Investments

While prime areas like Lutyens’ Delhi and Gurugram’s Golf Course Road have long been synonymous with luxury, the current surge is marked by the emergence of new, strategic hubs. These areas are not just extensions of existing markets but are becoming self-sufficient ecosystems, fueled by major infrastructure developments. The article highlights several key locations that are now the epicenter of the luxury real estate NCR boom:

- Dwarka Expressway: This 29-kilometer-long expressway has emerged as a game-changer. It provides seamless connectivity between Dwarka in Delhi and Gurugram, while also offering a direct route to the Indira Gandhi International (IGI) Airport. The completion of this crucial infrastructure has dramatically enhanced property values along the corridor. It is attracting top-tier developers who are launching large-scale residential and commercial projects, catering to the growing demand from professionals working in Gurugram and Delhi. Properties here are showing strong appreciation and are being considered a prime spot for both end-users and long-term investors.

- New Gurugram: Located along the Dwarka Expressway and NH-8, New Gurugram is a meticulously planned micro-market that offers a balanced mix of residential and commercial spaces. Its strategic location, coupled with excellent social infrastructure including schools, hospitals, and shopping centers, is attracting a new demographic of young professionals and families. This area is rapidly developing into a premium living destination, with a number of luxury projects that promise a high-quality lifestyle and significant returns on investment.

- Noida and the Yamuna Expressway: The real estate narrative in Noida has always been one of forward-looking development, but the upcoming Noida International Airport at Jewar is set to propel it into a new league. This mega-project is a key catalyst for real estate growth, especially along the Yamuna Expressway. This corridor is now attracting significant interest from developers and investors alike, with new residential and commercial projects catering to a wide range of budgets, including high-end luxury. The long-term investment potential here is immense, with experts predicting a phenomenal appreciation in property values.

Investment Appeal: Beyond Capital Appreciation

The appeal of luxury real estate NCR extends beyond simple capital appreciation. These properties offer a compelling value proposition for investors, including strong rental yields. With a constant influx of expatriates, corporate leaders, and high-income professionals, the demand for rental properties in these luxury segments remains high. This ensures a steady stream of passive income for investors. Furthermore, the transparency brought about by regulatory bodies like RERA has instilled greater confidence in the market, making it a secure and attractive asset class. Developers are focusing on timely delivery, superior construction quality, and transparent processes, which are key factors for both domestic and international buyers.

A Look at the Future: Sustained Growth and New Benchmarks

The trajectory for the luxury real estate NCR market appears to be one of sustained and robust growth. The region’s real estate landscape is being defined by a move towards premium and ultra-luxury offerings. As disposable incomes continue to rise and aspirations for an international standard of living become more prevalent, the demand for these properties will only grow.

The government’s ongoing commitment to infrastructure development – including new expressways, metro lines, and the Jewar airport -will continue to be the primary driver of this growth, unlocking new areas and further solidifying the NCR’s position as India’s leading luxury property hub. For those seeking to invest in the future of Indian real estate, a strategic focus on the luxury segment in these emerging hubs offers a clear path to high returns and unparalleled value.

Luxury Real estate NCR

Luxury real estate NCR

Luxury Real estate NCR

Source – MC