Major Gurugram Land Acquisition by Signature Global: A Deep Dive into the ₹450 Cr Deal

In a move that has captured the attention of the real estate industry, Signature Global, a major player in India’s residential property market, has successfully acquired a vast 33.47-acre land parcel in the burgeoning micro-market of Sohna, Gurugram. The deal, valued at approximately ₹450 crore, signifies a bold strategic step by the company to expand its development capabilities and capitalize on the immense potential of the Gurugram region. The transaction was a result of three distinct sale deeds, reflecting the complexity and scale of the Gurugram land acquisition. This development is particularly noteworthy as it follows a period of exceptional performance for the company, which recently achieved the fifth-largest pre-sales volume in the country.

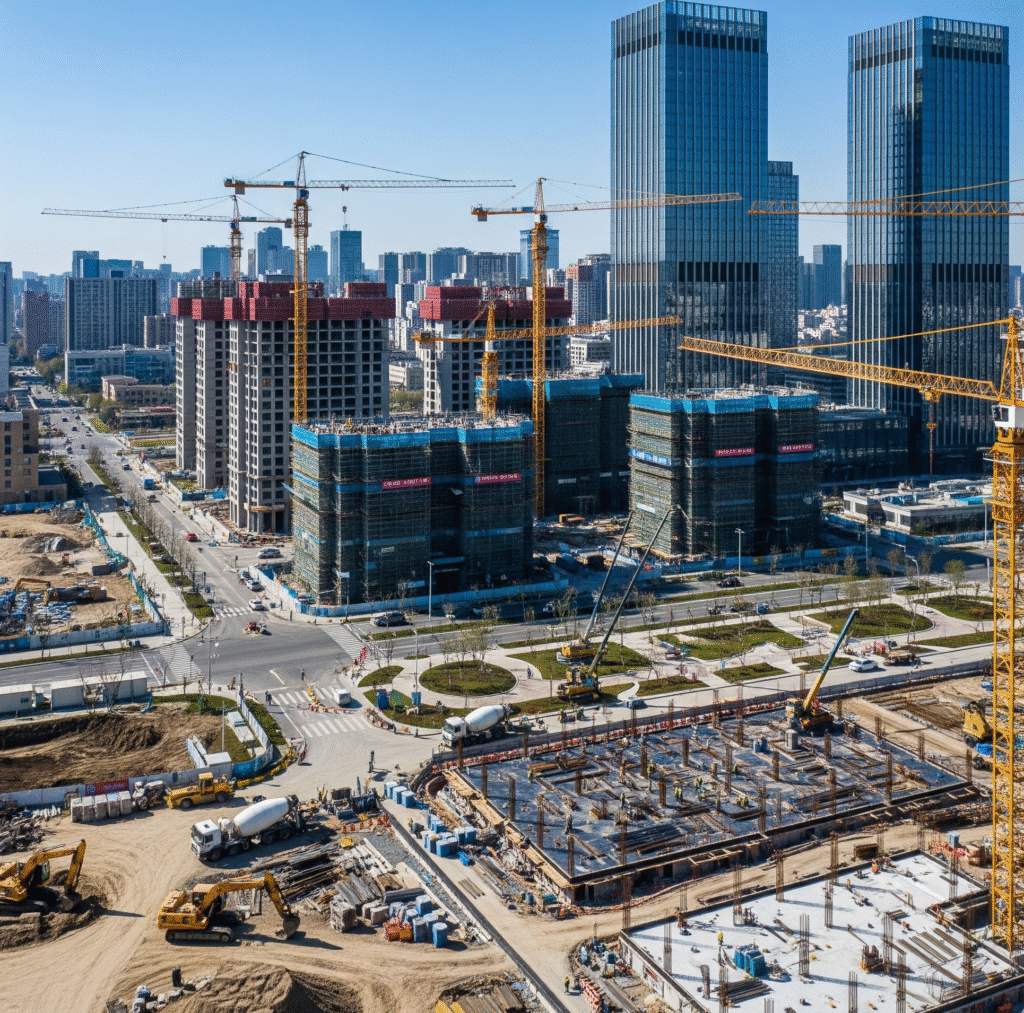

Gurugram land acquisition

The Gurugram real estate sector has been on a strong growth trajectory, driven by its status as a leading corporate and IT hub. The Sohna sub-market, in particular, has gained prominence due to its connectivity to the Southern Peripheral Road (SPR) and its planned integration into the broader urban development plan. Signature Global’s decision to pursue this Gurugram land acquisition demonstrates its commitment to high-growth areas and its ability to identify and secure valuable land assets. The land parcel’s significant development potential of 18 lakh square feet will allow the company to create an extensive housing project, catering to a diverse range of homebuyers. This aligns with the company’s vision of providing quality homes in prime locations.

This latest acquisition is a key component of Signature Global’s long-term business strategy. The company’s chairman, Pradeep Kumar Aggarwal, has been vocal about the firm’s focus on aggressive land banking. He has stated that the company aims to acquire land parcels that are equivalent in value to the projects it plans to launch in a given fiscal year. This forward-thinking approach ensures a continuous pipeline of projects and a steady stream of revenue.

Following a substantial investment of ₹1,070 crore for land acquisition in the previous fiscal year, the company has even more ambitious plans for the current year, earmarking between ₹1,200 to ₹1,500 crore for new land purchases across the Delhi-NCR. This proactive strategy is a testament to the company’s robust financial health and its long-term vision.

The impact of this Gurugram land acquisition extends beyond the company’s balance sheet. For the real estate market, it signals a renewed confidence in the sector, especially as consumer demand remains strong for well-located and well-developed projects. For investors, it reinforces Signature Global’s position as a reliable and growing enterprise, with a clear path for future revenue generation.

The company’s remarkable performance in the last fiscal year, with total sales of ₹10,290 crore, serves as a strong foundation for its ambitious target of ₹12,500 crore in sales bookings for the current fiscal year. With its strategic focus on acquiring prime land and a proven track record of project execution, this Gurugram land acquisition is a pivotal moment for Signature Global, positioning it for continued leadership and growth in India’s competitive real estate landscape.

In a move that has captured the attention of the real estate industry, Signature Global, a major player in India’s residential property market, has successfully acquired a vast 33.47-acre land parcel in the burgeoning micro-market of Sohna, Gurugram. The deal, valued at approximately ₹450 crore, signifies a bold strategic step by the company to expand its development capabilities and capitalize on the immense potential of the Gurugram region. The transaction was a result of three distinct sale deeds, reflecting the complexity and scale of the Gurugram land acquisition. This development is particularly noteworthy as it follows a period of exceptional performance for the company, which recently achieved the fifth-largest pre-sales volume in the country.

The Gurugram real estate sector has been on a strong growth trajectory, driven by its status as a leading corporate and IT hub. The Sohna sub-market, in particular, has gained prominence due to its connectivity to the Southern Peripheral Road (SPR) and its planned integration into the broader urban development plan. Signature Global’s decision to pursue this Gurugram land acquisition demonstrates its commitment to high-growth areas and its ability to identify and secure valuable land assets. The land parcel’s significant development potential of 18 lakh square feet will allow the company to create an extensive housing project, catering to a diverse range of homebuyers. This aligns with the company’s vision of providing quality homes in prime locations.

This latest acquisition is a key component of Signature Global’s long-term business strategy. The company’s chairman, Pradeep Kumar Aggarwal, has been vocal about the firm’s focus on aggressive land banking. He has stated that the company aims to acquire land parcels that are equivalent in value to the projects it plans to launch in a given fiscal year.

This forward-thinking approach ensures a continuous pipeline of projects and a steady stream of revenue. Following a substantial investment of ₹1,070 crore for land acquisition in the previous fiscal year, the company has even more ambitious plans for the current year, earmarking between ₹1,200 to ₹1,500 crore for new land purchases across the Delhi-NCR. This proactive strategy is a testament to the company’s robust financial health and its long-term vision.

Gurugram Land acquisition

Source : ET