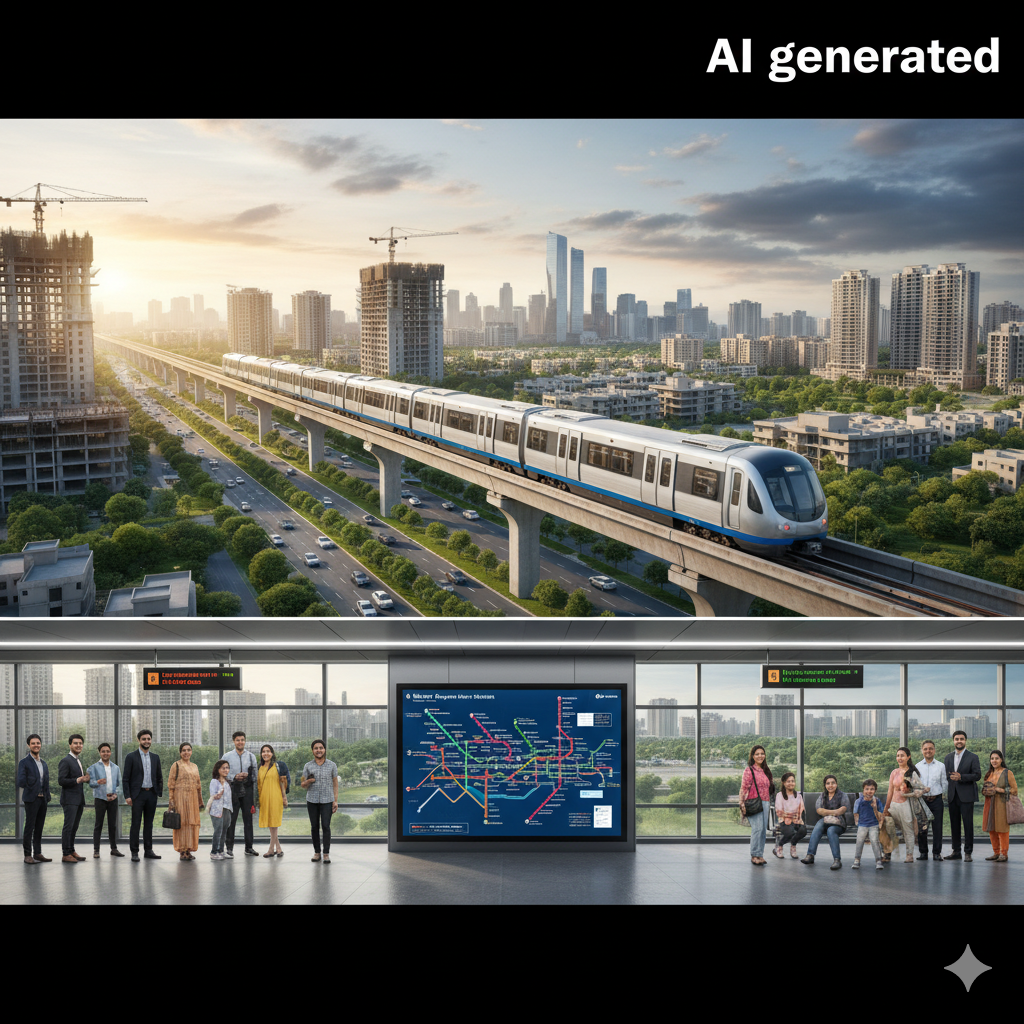

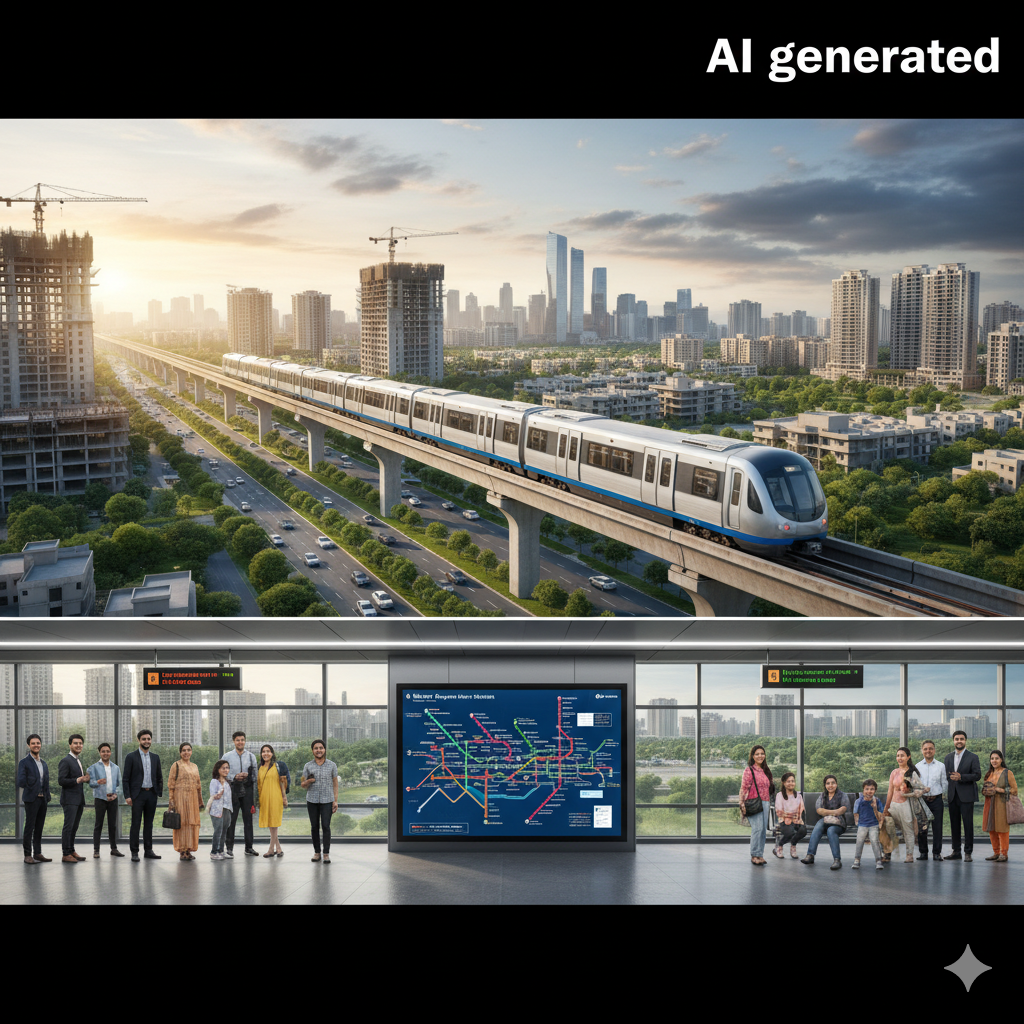

New Gurgaon Metro Project: Boosting Realty Market & Connectivity

New Gurgaon Metro: A Game Changer for Realty The urban sprawl of Gurgaon, now officially Gurugram, is constantly evolving. A […]

New Gurgaon Metro: A Game Changer for Realty The urban sprawl of Gurgaon, now officially Gurugram, is constantly evolving. A […]

Noida to Gurugram in 1 Hour: A Realty with Namo Bharat Rail Imagine a world where the daily commute between […]

A New Benchmark for Luxury Living In the bustling real estate landscape of Gurugram, a new landmark project is set […]

The Current State of Gurgaon Real Estate Investment Gurgaon real estate investment:-Gurgaon, once a quiet suburb, has transformed into a […]

Gurugram Metro Real Estate-The urban landscape of Gurugram is on the brink of a major transformation, one that promises to […]

Gurugram real estate – often hailed as the corporate and luxury hub of the National Capital Region (NCR), is facing […]

Gurgaon Builder Gangster – In a city defined by its gleaming skyscrapers and corporate parks, a shadow is growing. A […]

Indian Urban Development – The face of India’s real estate sector is changing rapidly. The National Capital Region (NCR) stands […]

The recent dismissal of an anticipatory bail plea by a sessions court in Gurgaon is more than just a legal […]

Developer Forgery Charges – In the complex and often opaque world of real estate, trust is the most valuable currency. […]