Justice Served: Gurgaon Developer Faces Strict Penalties for Four-Year Project Delay

In a significant victory for consumer rights, Gurgaon Developer has been held accountable for a staggering four-year delay in delivering a commercial property. The Haryana Real Estate Regulatory Authority (HRera) has delivered a decisive verdict against Shine Buildcon Pvt Ltd, ordering them to compensate the aggrieved buyer and immediately move to transfer possession of the unit.

The case revolves around a commercial unit in the ’70 Grandwalk’ project, which the buyer had been waiting for since their initial investment. The gurgaon developer attempts to justify the extreme delay by citing events like demonetization and the COVID-19 pandemic were dismissed by the authority. HRera concluded that these circumstances did not warrant such a prolonged failure to deliver on their contractual obligations.

As a consequence of their findings, HRera has imposed a two-pronged penalty on the builder. Firstly, the firm must pay the complainant interest at a rate of 11.1% per annum for the entire period of the delay. Secondly, they have been given a strict 30-day deadline to hand over the possession of the unit, contingent on the buyer clearing any outstanding dues.

The regulatory body also uncovered that the gurgaon developer had imposed charges that were not part of the original buyer’s agreement. In its ruling, HRera mandated that all fees must be strictly aligned with the initial contract, protecting the buyer from any illicit financial demands.

This ruling sends a powerful message to the real estate industry, reinforcing that regulatory bodies are actively protecting the interests of homebuyers and that developers cannot expect to get away with unreasonable delays and unfair practices. It serves as a beacon of hope for other buyers who may be facing similar struggles with delayed projects.

Source : TOI

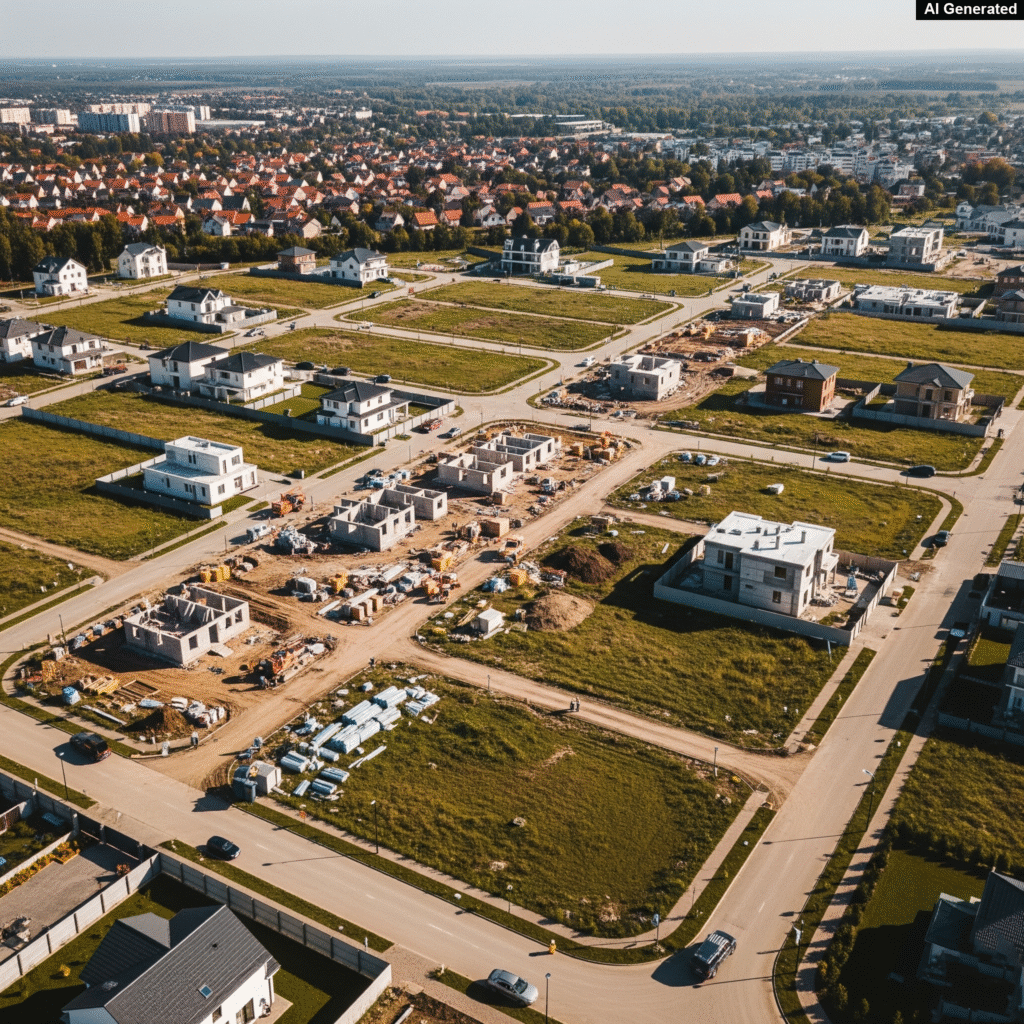

Max Estate plans to build 4 million square feet in Gurugram and hopes to make ₹ 9,000 crores.

A joint development agreement has been signed by Max Estates, the real estate division of the Max Group, for the development of 18.23 acres of land in Gurgaon. The project has the potential to generate revenue of Rs 9,000 crore.

This land tract is adjacent to the 11.80 acres of existing land on the Dwarka Expressway in Gurugram’s sector 36 A, on which Max Estates executed a Joint Development Agreement (JDA) the previous year. The land has the potential to accommodate nearly 4 million square feet of development.

With a revaluated revenue potential of Rs 4,000 Crore, the firm is on pace to open the first intergenerational residential community in the Delhi NCR in Q3 of CY 2024.

This aids Max Estates in solidifying its 30 acer holding in sector 36A of the Dwarka Expressway, which has become a sought after luxury residential area in Gurugram as a result of significant infrastructure improvements.

Both options suggest that by building and selling an area larger than 6.4 million square feet, Gurugram might generate a total revenue potential of Rs 13,000 crore over time.

“Securing at least 2 million square feet of development opportunity in Delhi NCR year for Max Estates is a key component of our stated expansion strategy. Max Estates’ portfolio, which is highly well diversified in terms of asset classes (commercial office and residential), geographic footprint (Noida, Delhi, and Gurugram), and risk spectrum (delivered and under construction), will grow by 50% from 8 to 12 million square feet of development potential after this transaction closes, according to COO Rishi Raj of Max Estates.

The legally binding agreement calls for working with the landowner to obtain a license under the Transit Orient Development (TOD) policy and securing development opportunities through JDAs over the course of three tranches.

New York Life Insurance Co. recently declared that it would invest a total of Rs 388 crore to purchase a 49% interest in two of Max Estates’ commercial projects, one in Noida and one in Delhi.

At the moment, New York Life owns 22.67% of Max Estates, which is listed publicly. Additionally, it owns 49% of the equity in Max Estates’ new commercial developments in the Delhi-NCR, which include Max Square, which is already functioning on the Noida Expressway, as well as two ongoing projects: Max Square Two, which is being built next to Max Square, and one on Gurugram’s Golf Course Extension Road.

The company successfully launched and sold Estate 128 in Noida, its first residential project, in 2023. It intends to begin work on its second project in Gurugram during the first part of this year.