Real estate

Real estate

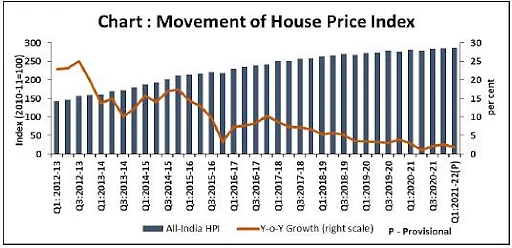

Housing Prices Rise in 43 Cities in March Quarter of FY23

The National Housing Bank (NHB) has released its latest housing price index, which shows that housing prices rose in 43 cities in the March quarter of FY23. The index, which measures the average price of residential properties across India, rose by 1.5% in the March quarter.

The rise in housing prices was led by eight key primary residential markets, namely Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Kolkata, Mumbai, and Pune. These markets saw an average increase of 2.1% in housing prices in the March quarter.

The rise in housing prices is being attributed to a number of factors, including:

- Increased demand: The demand for housing has been on the rise in recent months, driven by factors such as rising income levels, lower interest rates, and the government’s push for affordable housing.

- Limited supply: The supply of housing has been limited in recent years, due to factors such as delays in land acquisition and approvals.

- Rising input costs: The cost of construction materials has been rising in recent months, which has led to an increase in the cost of housing.

The rise in housing prices is expected to continue in the coming months, but the pace of growth is likely to moderate. The NHB has forecast that housing prices will rise by 5.5% in FY23.

The rise in housing prices is a positive development for the real estate sector, but it could also pose a challenge to first-time homebuyers. Homebuyers should carefully consider their financial situation before making a purchase, and they should also be aware of the risks associated with buying a home in a rising market.

Here are some of the key takeaways from the NHB report:

- Housing prices rose in 43 cities in the March quarter of FY23.

- The average increase in housing prices was 1.5%.

- Eight key primary residential markets saw an average increase of 2.1% in housing prices.

- The rise in housing prices is being attributed to increased demand, limited supply, and rising input costs.

- The NHB has forecast that housing prices will rise by 5.5% in FY23.

What does this mean for homebuyers?

The rise in housing prices is a positive development for the real estate sector, but it could also pose a challenge to first-time homebuyers. Homebuyers should carefully consider their financial situation before making a purchase, and they should also be aware of the risks associated with buying a home in a rising market.

Here are some tips for homebuyers in a rising market:

- Do your research and understand the local real estate market.

- Get pre-approved for a mortgage before you start shopping for a home.

- Be prepared to act quickly when you find a home that you like.

- Be realistic about your budget and don’t overstretch yourself.

- Be prepared to compromise on some of your requirements.

The rise in housing prices is a good sign for the Indian economy, but it is important for homebuyers to be aware of the risks involved before making a purchase.